The math on Bitcoin mining doesn't work—unless transaction fees grow substantially.

The thesis: These aren't mining companies. They're power infrastructure companies that happen to be mining Bitcoin. If fees stay low, value them on what an HPC buyer would pay for the megawatts—not on mining economics.

I ran a mining operation for 14 months. Watched my yields drop 44%—same hardware, same electricity—as rising prices attracted competition that crushed individual returns. That's when I understood the capex treadmill isn't theoretical. This piece is the framework I built to think about what these companies are actually worth.

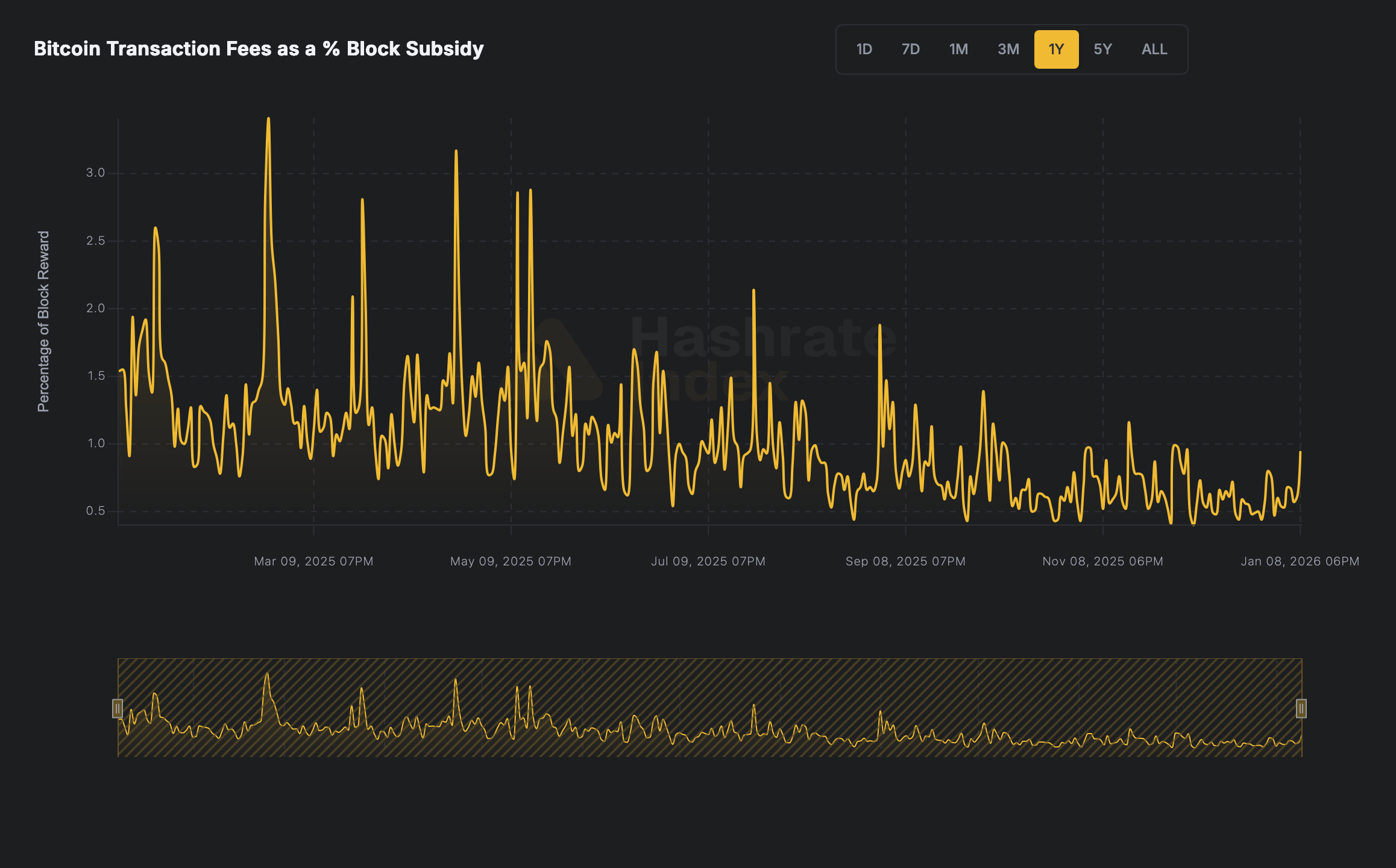

Transaction fees are currently ~1% of block rewards (as of January 2026). Block rewards halve every four years. Without fee growth, miner revenue per block gets cut in half on a fixed schedule, while competition for that shrinking pie intensifies. The capex treadmill—buy newer machines or get squeezed out—never stops.

CoreWeave offered $6.9M per operational megawatt to acquire Core Scientific in July 2025. Shareholders rejected it as too low. That's the acquisition benchmark—what a strategic buyer with HPC capabilities demonstrated willingness to pay. As of early January 2026, CleanSpark trades at $3.5M/MW—a 49% discount. RIOT at $4.8M/MW—30% off. The gap is the market pricing in execution risk: can these management teams pivot from mining to HPC?

If transaction fees don't materially increase, mining output is noise—the power is the asset. Whether that asset gets unlocked depends on execution.

The Math Problem

Hash price—revenue per petahash per day—captures everything miners care about in a single number:

Hash Price = (Block Reward + Tx Fees) × Blocks/Day × BTC Price

─────────────────────────────────────────────────

Network Hashrate

What's fixed:

- Blocks per day: ~144 (not changing)

- Block reward: 3.125 BTC now, halving to 1.5625 BTC in ~2028

What can go up:

- BTC price — helps, but you can't build a business model on it

- Transaction fees — the only sustainable lever

What would help but signals failure:

- Network hashrate declining — improves hash price but means miners are leaving

Current hash price (January 2026): ~$39 per petahash/day (PH/day) — near all-time lows [5].

This is the proof. Hash price captures block rewards, transaction fees, BTC price, and network competition. It's showing miners getting squeezed harder than ever—even as Bitcoin trades above $90,000 [5].

The Capex Treadmill

Here's the trap: efficiency gains get competed away immediately.

You buy new S21 miners. Your efficiency improves 20%. You mine more bitcoin per megawatt. Great—except every other miner does the same thing. Network hashrate increases. Difficulty adjusts upward. Your share of total mining rewards stays flat or declines.

The only way to maintain share is to keep buying. New machines every 18-24 months. Constant capital expenditure. No moat.

This is why valuing miners on bitcoin production is a mistake. Production is a function of network difficulty, which is a function of how much everyone else is spending on hardware.

Case Studies: The Numbers Don't Lie

Two miners with transparent reporting show the pattern [1][2][3][4].

| Company | Period | Hashrate Growth | BTC Production |

|---|---|---|---|

| CleanSpark | Dec '24 → Dec '25 | +28% | -7% |

| IREN | Aug '24 → Aug '25 | +302% | +173% |

CleanSpark grew hashrate 28% and mined less bitcoin. IREN 4x'd their machines but only 2.7x'd output. Difficulty ate the rest.

CleanSpark's selling pressure: 12 BTC sold in December 2024. 577 BTC sold in December 2025—from HODLing to dumping 93% of production. Other red flags: 1,647 BTC posted as collateral, 56% power utilization.

IREN's cost squeeze: Cost per BTC rose 29% ($29,958 → $38,791) despite newer hardware. Margins only held because BTC price nearly doubled. (Note: IREN has since secured a $9.7B Microsoft AI contract.)

Industry-wide transparency problem: Many miners have stopped publishing monthly updates entirely. The numbers are bad and they don't want to show them.

Transaction Fees: The Upside Variable

Block rewards halve every four years. Currently 3.125 BTC per block, dropping to 1.5625 BTC in ~2028. The math only works long-term if transaction fees grow to replace declining block rewards.

Current transaction fees (January 2026): ~1% of block rewards [5].

The chart tells the story: fees spike above 3% during congestion but always revert. The baseline stays subdued—below 1% of block rewards. That's the current state. But this is the wild card: if Bitcoin usage grows 10-20x, fees could become meaningful revenue.

| Scenario | Fee Level | Block Value | vs. Today |

|---|---|---|---|

| Today | ~1% | $315K | — |

| Post-halving (same fees) | ~1% | $158K | -50% |

| Post-halving (sustainable high) | 30-40% | $200-225K | -28% to -35% |

| Post-halving (2017 spike) | 50%+ | $315K+ | flat |

You need fees to reach ~50% of block value just to stay flat post-halving. Has it happened? Yes—December 2017 hit 78% briefly when fees exceeded $50/transaction. But those spikes lasted days, not months. Users fled to alternatives.

Today's escape valve: Lightning Network. When on-chain fees spike, activity moves off-chain. The sustainable ceiling is probably 30-40% of block reward—still transformative for miners, but not the full offset.

The bottom line:

- At current ~1% fees → 50% revenue cut post-halving

- At sustainable 30-40% fees → 30% revenue cut post-halving

The difference between survival and crisis.

These are networks—and networks have historically surprised with adoption curves steeper than expected. The precedent for exponential growth exists.

Power Is the Real Asset

The shift in how to value them:

- Traditional metrics: Bitcoin mined, hashrate growth

- AI/HPC metrics: MW operational, MW in development, price per MW of capacity

Power reporting is messy. Companies report:

- Contracted power — deal on paper

- Operating/utilized power — actually built and running

- Pipeline/development — theoretical future capacity

CleanSpark: 1.45 GW contracted, 808 MW utilized. Where's the other 44%?

IREN: 160 MW operating in BC, 750 MW at Childress (650 MW operational), 2,000 MW at Sweetwater (not built). They claim ">3,000 MW total"—but most is pipeline.

The AI/HPC pivot makes sense through this lens. Bitcoin mining and HPC have similar requirements:

- Concentrated power access

- Data center infrastructure (cooling, power delivery)

- Similar site selection criteria

The key execution barrier: latency. Bitcoin mining is latency-agnostic—hash wherever power is cheapest, even if it's 200 miles from the nearest fiber line. Mining sites process small transaction data and don't need high-speed bandwidth. Most operate with minimal network infrastructure: basic internet, no enterprise-grade fiber, no redundant routing [8].

AI inference is the opposite. Enterprise customers need low-latency connections to move large datasets in and out. Converting a mining site to HPC-ready requires procurement and installation of high-speed fiber, routers, and redundant connections—infrastructure that doesn't exist at most mining facilities.

The cost: Aerial fiber installation runs approximately $50,000 per mile [9]. A remote site 50 miles from the nearest fiber backbone is looking at $2.5M+ just for the line, before switching equipment, redundancy, and ongoing maintenance. Sites in truly remote locations—where power is cheapest—face the steepest buildout costs.

Who's actually building: The miners fall on a spectrum from "executed" to "exploring." IREN and Cipher Mining are the only two with signed hyperscaler contracts [7][13]. RIOT is building fiber connectivity at Corsicana [10]. CleanSpark acquired Texas land and hired an AI data center team, but has no customers yet [14][15]. MARA is piloting projects.

The pattern: contracts are proof of pivot. Everything else is infrastructure speculation.

The ideal setup: infrastructure that can shift between Bitcoin mining and AI/HPC depending on which has better unit economics. Hash price favorable? Mine Bitcoin. Hash price compressed? Rent GPU capacity for inference. But getting there requires solving the latency problem first.

The Acquisition Benchmark

In July 2025, CoreWeave offered $9 billion for Core Scientific's 1.3 GW of operational power [6]. The implied valuation: $6.9M per operational MW.

The deal failed. Shareholders voted against it 10-to-1 [11]. Two Seas Capital, the largest shareholder, argued it undervalued the power assets.

The aftermath: Core Scientific now trades at ~$5.7B—roughly $4.4M per MW [12]. Shareholders rejected $6.9M/MW; three months later, they're trading 37% below that price.

The failed deal is more informative than a completed one. It establishes $6.9M/MW as the benchmark—what an HPC buyer demonstrated willingness to pay. Any miner trading well below this with real power capacity is either undervalued or facing execution risk the market doesn't trust them to overcome.

Evaluation Framework

Three scenarios would change how you value these companies:

1. Transaction fees grow sustainably. If fees reach 30-40% of block rewards and hold, mining economics work again—value on cash flows, not just power infrastructure.

2. HPC contracts get signed. Contracted revenue from hyperscalers (major cloud providers like AWS, Microsoft, Google) can be DCF'd (discounted cash flow analysis). The more contracts, the less you're valuing on speculative power potential.

3. Unique power economics emerge. Stranded hydro, flare gas, or regulatory advantages that competitors can't replicate create real moats—not just megawatts anyone could build.

Without one of these, EV/MW (enterprise value per megawatt) is your best screen. Enterprise value accounts for debt—and leverage cuts both ways. A leveraged miner looks more expensive per MW, but equity holders capture amplified upside if the pivot works. If it doesn't, fixed debt on declining cash flows accelerates the problem. Most miners don't have contracts yet—the framework answers: what would an HPC buyer pay for this power?

What drives a miner's valuation?

1. Real power assets. Not pipeline—operational megawatts generating revenue today. The gap between "contracted" and "utilized" power matters, but context matters more. CleanSpark's 56% utilization could mean new capacity ramping up, seasonal curtailment agreements, or strategic reserve for expansion. It becomes a warning sign if utilization stays flat while capex keeps flowing—that's capital tied up not generating returns.

2. Valuation below the acquisition benchmark. CoreWeave offered $6.9M per operational MW—shareholders rejected it as too low. Public markets can and do trade below this; the discount is execution risk plus minority stake illiquidity. Anyone trading well below with real power may be undervalued—if they can execute. Anyone above it without contracts is pricing in hope.

3. HPC execution progress. Not press releases—GPUs deployed, fiber connectivity built, enterprise customers signed, revenue flowing. The latency problem is real. Who's solving it?

4. Balance sheet to survive the transition. Companies dumping 90%+ of production to fund operations are one bad quarter away from dilutive equity raises or forced asset sales. The pivot takes time; cash buys time.

Valuation framework:

- EV per MW operational vs. $6.9M benchmark

- EV per MW in portfolio (contracted + development) vs. $3.9M benchmark

- Progress toward HPC contracts and revenue

- Cash runway and selling pressure

The EV/MW framework provides a useful first-pass screen.

Current Valuations vs. Benchmark

The chart shows how markets price execution risk. IREN trades at a premium ($17.3M/MW)—contracts justify the valuation. MARA trades near parity ($6.0M/MW) but carries significant debt. RIOT ($4.8M/MW) and CleanSpark ($3.5M/MW) trade at steeper discounts—infrastructure in progress, no contracts yet.

Conclusion

The math on Bitcoin mining doesn't work at current fee levels. Without sustained fee growth or an HPC pivot, value these companies on their power infrastructure—not their hashrate.

The execution spectrum: IREN and Cipher have signed contracts worth billions. RIOT and CleanSpark are building infrastructure without customers. The discount to the CoreWeave benchmark reflects where each company sits on that curve.

Catalysts to watch: Fee growth that sustains beyond a single cycle. HPC contracts with disclosed terms. M&A that reprices the $/MW benchmark. For early-stage pivoters: the first real customer.

The mining output is noise. The power is the asset. The contract is the proof.

Sources

[1] CleanSpark December 2024 Mining Update

[2] CleanSpark December 2025 Mining Update

[3] IREN August 2024 Monthly Update

[4] IREN August 2025 Monthly Update

[5] Hashrate Index: Hash Price and Network Data

[6] CoreWeave to Acquire Core Scientific

[7] IREN Secures $9.7B AI Cloud Contract with Microsoft

[8] Altman Solon: Crypto's High-Performance Computing Opportunity

[9] Dgtl Infra: Fiber Optic Network Construction Costs

[10] RIOT Platforms Q1 2025: AI Data Center Pivot

[11] Core Scientific Announces Termination of Merger Agreement with CoreWeave

[12] Core Scientific (CORZ) Valuation & Financial Statistics

[13] Cipher Mining AWS and Fluidstack Contracts